- With a number of international magazines expanding operations in India, the market is expected to continue growing, in spite of the growth of digital, mobile and social media.

- Business magazines are by far the most common and popular in India, followed by entertainment (Bollywood), current affairs, fashion and travel magazines.

- Concepts such as integrated newsroom, OneIndia, and capacity sharing are emerging in the industry.

- Growth in Tier II and Tier III cities is providing a steady impetus to the Indian print industry.

- Emerging economies such as China, India, Russia and South Africa will see the fastest growth in B2B magazines.

- Between 2013 and 2018, India is projected to be the second fastest growing advertising market in Asia.

"Given India’s demographics and socioeconomic parameters, there is a huge amount of runway left for the print industry in general, Hindi in particular, to grow in terms of volume and revenue. The threat posed by digital media is mostly applicable to the big cities, while the regional markets still remain relatively insulated."

Piyush Gupta

Chief Financial Officer, HT Media"In the past decade, regional dailies have witnessed much higher revenue growth rate than their English counterparts. This has primarily been driven by higher consumption growth and thus the increased focus of advertisers on Tier !! and Tier III towns. A combination of these factors makes the future look quite promising for regional language publications."

Bijoy Sreedhar

Sr. Executive Vice President Lokmat"Growing middle classes will drive consumer magazine revenue. Countries such as India and Mexico are seeing growth in their middle classes spurring total consumer magazine revenue, with forecast CAGRs of 4.5% and 3.8%, respectively. Importantly, these countries are still seeing growth in print as the emerging consumer classes buy lifestyle magazines and those focused on luxury goods."

Global Entertainment Media Outlook

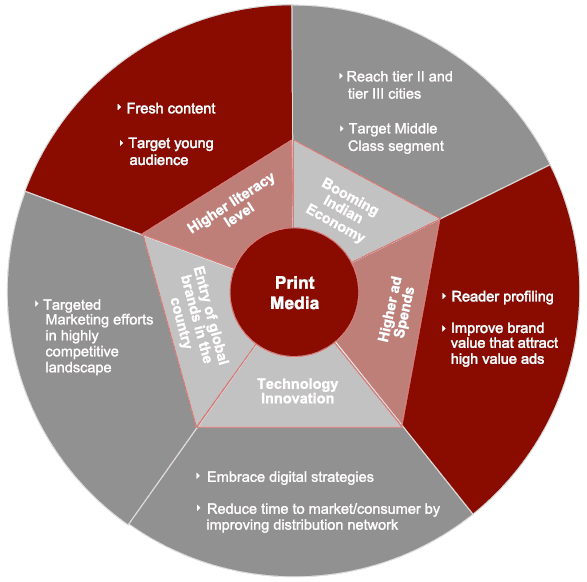

PWCBusiness Drivers

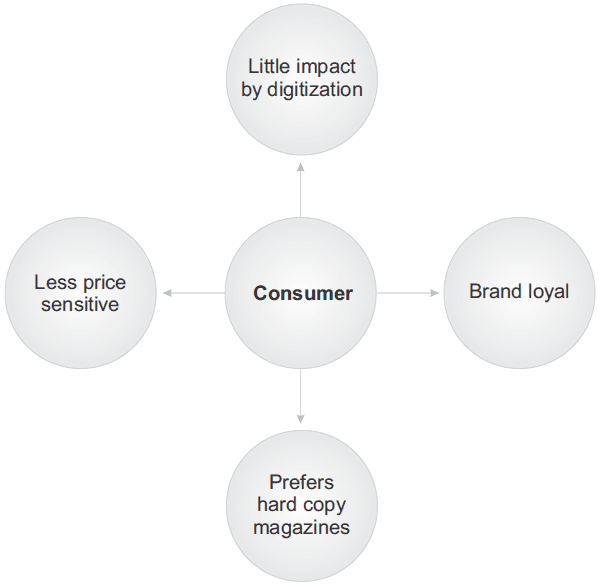

Consumer Behavior

Print Media Market Size

| US $ (million) | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|

| Advertising Revenue | 1.90 | 2.1 | 2.26 | 2.46 | 2.66 |

| Circulation Revenue | 1.01 | 1.04 | 1.13 | 1.22 | 1.31 |

| Total Print Market | 2.91 | 3.14 | 3.39 | 3.68 | 3.97 |

| Newspaper Revenue | 2.75 | 2.97 | 3.18 | 3.47 | 3.76 |

| Magazine Revenue | 0.16 | 0.18 | 0.19 | 0.21 | 0.21 |

| Total Print market | 2.76 | 3.15 | 3.37 | 3.68 | 3.97 |

Note: Slight variation in the sum total of "Total Print market" is due to conversion of INR into USD currency

Source: FICCI –KPMG Report 2015

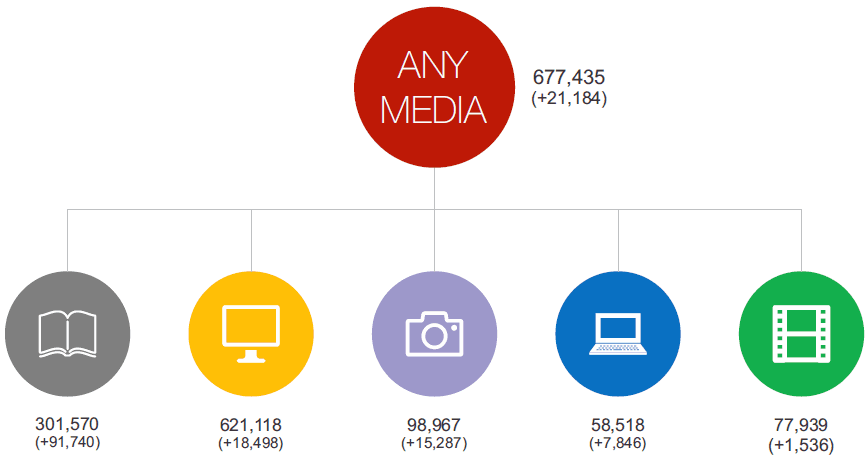

Media Consumption

Base (000s) - 962,389 Figures in 000s Figure in brackets indicate growth over IRS 2013

Source: IRS (Indian Readership Survey) 2014

Segmentation

Business World, Business Today Segment: business savvy readers

Femina, Cosmopolitan Segment: people at the top of the pyramid

Women's era, Savvy Segment: upper middle class women

Grihshobha, Manorama Segment: women in tier-2/3 cities

Tinkle, Chandamama, Champak Segment: kids

Top Magazines

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Vantiha | Malayalam | Fortnightly | 2,762 | 2,829 | 2% |

| Pratiyogita Darpan | Hindi | Monthly | 1,457 | 1,687 | 16% |

| India Today | English | Weekly | 1,532 | 1,634 | 7% |

| India Today | Hindi | Weekly | 1,151 | 1,364 | 9% |

| Saras Salil | Hindi | Fortnightly | 1,174 | 1,354 | 15% |

| Samanya Gyan Darpan | Hindi | Monthly | 1,094 | 1,309 | 20% |

| Grihshobha | Hindi | Fortnightly | 979 | 1,057 | 8% |

| Mathrubhumi Arogya Masika | Malayalam | Monthly | 928 | 974 | 5% |

| Manorama Thozil Veedh | Malayalam | Weekly | 1012 | 873 | -14% |

| Jagran Josh Plus | Hindi | Weekly | 783 | 821 | 5% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top English Magazines

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| India Today | English | Weekly | 1,532 | 1,634 | 7% |

| Pratiyogita Darpan | English | Monthly | 571 | 689 | 21% |

| General Knowledge Today | English | Monthly | 507 | 621 | 22% |

| The Sportstar | English | Weekly | 543 | 528 | -3% |

| Competition Success Review | English | Monthly | 394 | 466 | 18% |

| Outlook English | English | Weekly | 452 | 425 | -6% |

| Readers Digest | English | Monthly | 356 | 348 | -2% |

| Filmfare | English | Fortnightly | 276 | 342 | 24% |

| Diamond Cricket Today | English | Monthly | 263 | 321 | 22% |

| Femina | English | Fortnightly | 259 | 309 | 19% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top Hindi Magazines

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Pratiyogita Darpan | Hindi | Monthly | 1,457 | 1,687 | 16% |

| India Today | Hindi | Weekly | 1,151 | 1,364 | 19% |

| Saras Salil | Hindi | Fortnightly | 1,174 | 1,354 | 15% |

| Samanya Gyan Darpan | Hindi | Monthly | 1,094 | 1,309 | 20% |

| Grihshobha | Hindi | Fortnightly | 979 | 1,057 | 8% |

| Jagran Josh Plus | Hindi | Weekly | 783 | 821 | 5% |

| Cricket Samrat | Hindi | Monthly | 643 | 693 | 8% |

| Diamond Cricket Today | Hindi | Monthly | 404 | 639 | 58% |

| Meri Saheli | Hindi | Monthly | 562 | 634 | 13% |

| Sarita | Hindi | Fortnightly | 476 | 553 | 16% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top Regional Magazines

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Vanitha | Malayalam | Weekly | 2,762 | 2,829 | 16% |

| Mathrubhumi Arogya Masika | Malayalam | Monthly | 928 | 974 | 5% |

| Manorama Thozilveedhi | Malayalam | Monthly | 1,012 | 873 | -14% |

| Kumudam | Tamil | Weekly | 769 | 800 | 4% |

| Karmasangsthaan | Bengali | Monthly | 614 | 772 | 26% |

| Mathrubhumi Thozhilvartha | Malayalam | Weekly | 874 | 754 | -14% |

| Grihalakshmi | Malayalam | Monthly | 826 | 750 | -9% |

| Malayala Manorama | Malayalam | Weekly | 661 | 710 | 7% |

| Kungumam | Tamil | Weekly | 658 | 703 | 7% |

| Karmakshetra | Bengali | Weekly | 600 | 680 | 13% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top Newspapers

| Newspapers | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Dainik Jagran | Hindi | Daily | 15,527 | 16,631 | 7% |

| Hindustan | Hindi | Daily | 14,246 | 14,746 | 4% |

| Dainik Bhaskar | Hindi | Daily | 12,857 | 13,830 | 8% |

| Malayala Manorama | Malayalam | Daily | 8,565 | 8,803 | 3% |

| Daily Thanthi | Tamil | Daily | 8,156 | 8,283 | 2% |

| Rajasthan Patrika | Hindi | Daily | 7,665 | 7,905 | 3% |

| Amar Ujala | Hindi | Daily | 7,665 | 7,808 | 10% |

| The Time Of India | English | Daily | 7,665 | 7,590 | 5% |

| Mathrubhumi | Malayalam | Daily | 6,136 | 6,020 | -2% |

| Lokmat | Marathi | Daily | 5,601 | 5,887 | 4% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top English Newspapers

| Newspapers | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| The Time Of India | English | Daily | 7,254 | 7,590 | 5% |

| Hindustan Times | English | Daily | 4,335 | 4,515 | 4% |

| The Hindu | English | Daily | 1,473 | 1,622 | 10% |

| Mumbai Mirror | English | Daily | 1,084 | 1,195 | 10% |

| The Telegraph | English | Daily | 937 | 1,003 | 7% |

| The Economic Times | English | Daily | 722 | 834 | 16% |

| Mid Day | English | Daily | 500 | 573 | 15% |

| The Tribune | English | Daily | 453 | 507 | 12% |

| Deccan Herald | English | Daily | 458 | 442 | -3% |

| Deccan Chronicle | English | Daily | 337 | 361 | 7% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top Hindi Newspapers

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Dainik Jagran | Hindi | Daily | 15,527 | 16,631 | 7% |

| Hindustan | Hindi | Daily | 14,246 | 14,746 | 4% |

| Dainik Bhaskar | Hindi | Daily | 12,857 | 13,830 | 8% |

| Rajasthan Patrika | Hindi | Daily | 7,665 | 7,905 | 3% |

| Amar Ujala | Hindi | Daily | 7,071 | 7,808 | 10% |

| Patrika | Hindi | Daily | 4,628 | 4,847 | 5% |

| Prabhat Khabar | Hindi | Daily | 2,719 | 2,988 | 10% |

| Navbharat Times | Hindi | Daily | 2,480 | 2,736 | 10% |

| Hari Bhoomi | Hindi | Daily | 2,757 | 2,571 | -7% |

| Punjab Kesari | Hindi | Daily | 2,291 | 2,377 | 4% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

Top Regional Newspapers

| Magazines | Language | Periodicity | Readership* | Growth % | |

|---|---|---|---|---|---|

| 2013 | 2014 | ||||

| Malayala Manorama | Malayalam | Daily | 8,565 | 8,803 | 3% |

| Daily Thanthi | Tamil | Daily | 8,156 | 8,283 | 2% |

| Mathrubhumi | Malayalam | Daily | 6,136 | 6,020 | -2% |

| Lokmat | Marathi | Daily | 5,601 | 5,887 | 5% |

| Anandabazar Patrika | Bengali | Daily | 5,515 | 5,653 | 3% |

| Eenadu | Telugu | Daily | 5,380 | 5,608 | 4% |

| Gujarat Samachar | Gujarati | Daily | 4,339 | 4,642 | 7% |

| Daily Sakal | Marathi | Daily | 3,707 | 4,007 | 8% |

| Sandesh | Gujarati | Daily | 3,724 | 3,849 | 3% |

| Sakshi | Telugu | Daily | 3,368 | 3,694 | 10% |

Base (000s) - 962,389 * Air, Figures in 000s

Source: IRS 2014

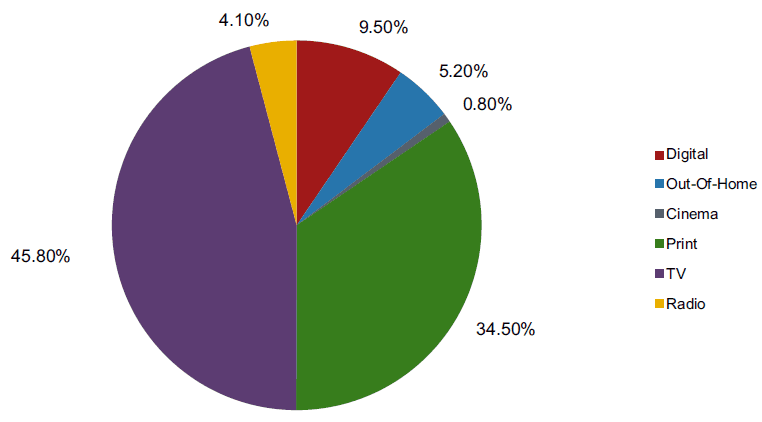

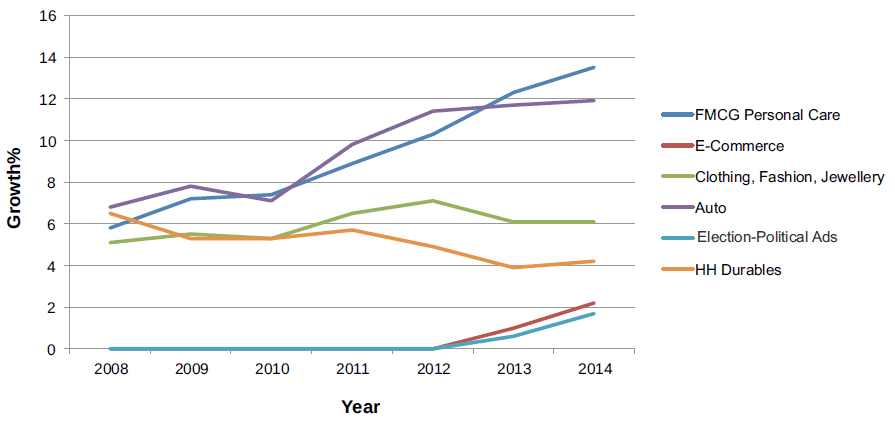

Advertising in India in 2015 Revenue Share

Big Spenders on Print

Source: Pitch Report 2015

Digital Advertising Market in India

"The Digital ad spend itself is a collection of multiple marketing strategies ranging from search and display advertising, to e-mail, mobile and video ads, social, sponsored content and more recently SMS based advertising. As marketers continue to increase the focus on technologies to effectively reach the customer through a mix of these online platforms, digital spends are projected to increase to USD 944 million by the end of 2015 at a YoY rate of 44 per Cent. The eCommerce industry has posted a growth of 338 per cent in ad spending, making it the top digital ad spender in 2014 with INR495 Cr, ahead of last year’s top spender, the telecom sector 47. The reason for the exponential jump in spends by eCommerce companies is their realization ROI using digital marketing techniques such as interest based targeting, mobile ads, native advertising and retargeting/remarketing. This ad spend figure is estimated to grow further, with an increasing number of customers migrating to e-tail and mcommerce."

Source: FICCI –KPMG Report 2015

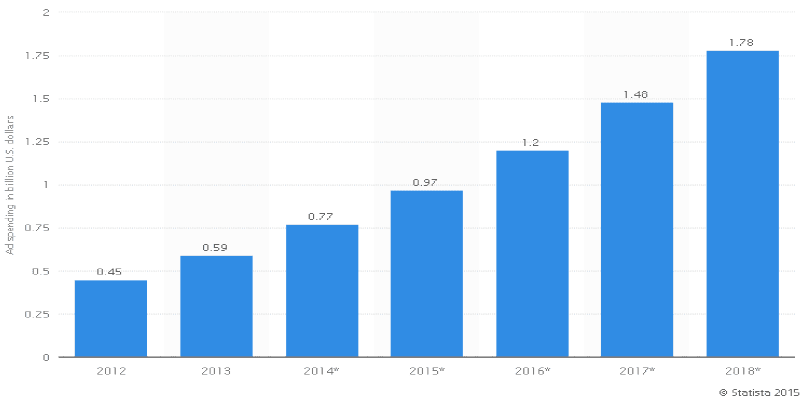

Digital advertising spending in India from 2012 to 2018

This statistic contains data on digital advertising spending in India in 2012 and 2013 with a forecast until 2018. The source projected the spending would grow from 0.45 billion U.S. dollars in 2012 to 1.78 billion in 2018.

Source: FICCI –KPMG Report 2015

Digital Media Industry Wise Ads Spends

| US $ (million) | 2013 | 2014 |

|---|---|---|

| E-Commerce | 17.08 | 74.82 |

| Telecom | 47.77 | 62.43 |

| FMCG | 54.72 | 58.20 |

| BFSI | 40.96 | 45.80 |

| Travel | 40.96 | 45.80 |

| Auto | 44.44 | 41.57 |

| Education | 23.88 | 29.17 |

| IT/ITeS | 27.36 | 33.25 |

| Others | 44.44 | 24.94 |

Source: FICCI –KPMG Report 2015

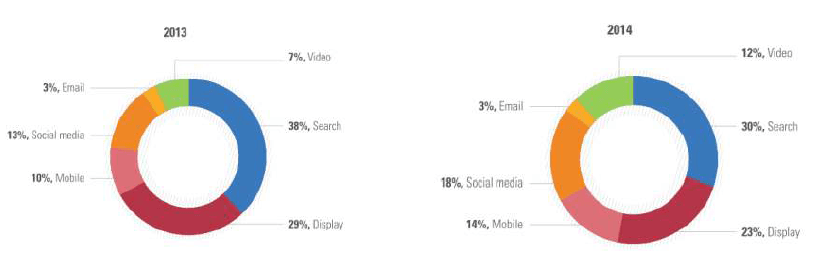

Digital ad spend mix in India

Traditionally, search and display advertising have dominated the digital ad spends. However, in 2014, while both search and display continued to maintain their lead, the percentage share of spend on these media dropped. On the other hand, better ad performance and greater scope of reach and engagement on mobile, social and video has been instrumental in improving their share to 14 per cent, 18 per cent and 12 per cent respectively in 2014.

Source: FICCI –KPMG Report 2015

Opportunities and Challenges

Opportunities

- Reach people when they are most likely to buy

- Tailored to advertising goals

- Efficient pricing

- Know where the ads appear

- Regional and vernacular markets will continue an upward trajectory

- Local language campaigns are leading to an increase in local advertising spends

Challenges

- Dependency on advertising for revenue

- Decrease in paid circulation sales over the past decade

- Competition from free Internet sources

- Adapt to the digital upheaval and technological challenges of keeping up with the evolving ecosystem

- To reskill and train the existing talent to adapt new technologies across key business performance areas

Indian Regulations - Foreign Direct Investment (FDI)

| Sector/Activity | % of Equity / FDI Cap | Entry Route |

|---|---|---|

| Publishing of newspaper and periodicals dealing with news and current affairs | 26% (FDI and investment by NRIs/PIOs/FII/FPI) | Government |

| Publication of Indian editions of foreign magazines dealing with news and current affairs | 26% (FDI and investment by NRIs/PIOs/FII/FPI) | Government |

| Publishing/printing of scientific and technical magazines/specialty journals/ periodicals, subject to compliance with the legal framework as applicable and guidelines issued in this regard from time to time by Ministry of Information and Broadcasting | 100% | Government |

| Publication of facsimile edition of foreign newspapers | 100% | Government |